In the context of buying a home, understanding your mortgage is crucial for making informed financial decisions. Many prospective homeowners are often overwhelmed by the numerous factors that go into calculating the true cost of a mortgage. It is necessary to look further than just the interest rate and monthly payment to understand the full picture. By being aware of what to factor in, you can avoid common pitfalls and ensure that you are fully prepared for your financial commitments.

Employing a mortgage calculator can be an essential tool in this process. It lets you to experiment with multiple loan amounts, interest rates, and terms to see how they influence your monthly payment and overall cost. However, a lot of individuals overlook important variables such as property taxes, insurance, and potential homeowner association fees. This article will lead you through the important calculations and considerations to provide a clearer understanding of what your mortgage actually entails.

Grasping Mortgage Principles

When considering a mortgage, it is essential to understand the meaning of a mortgage actually is. A mortgage is a loan particularly used to acquire real estate, in which the property itself serves as guarantee. This means that if you fail to pay back the loan, the lender has the power to repossess the real estate by way of a method known as foreclosing. Mortgages typically have long repayment terms, usually spanning 15 to 30 years, and are structured with various APR and installment plans.

One critical component of mortgages is the principal and finance charge payments. The principal is the original sum borrowed, while the interest is the cost of borrowing that money. As you make regular payments, a portion of your contribution goes into diminishing the principal, and the remainder goes toward interest. Knowing how these components work in conjunction is essential for calculating your monthly obligations and the total cost of your mortgage over time.

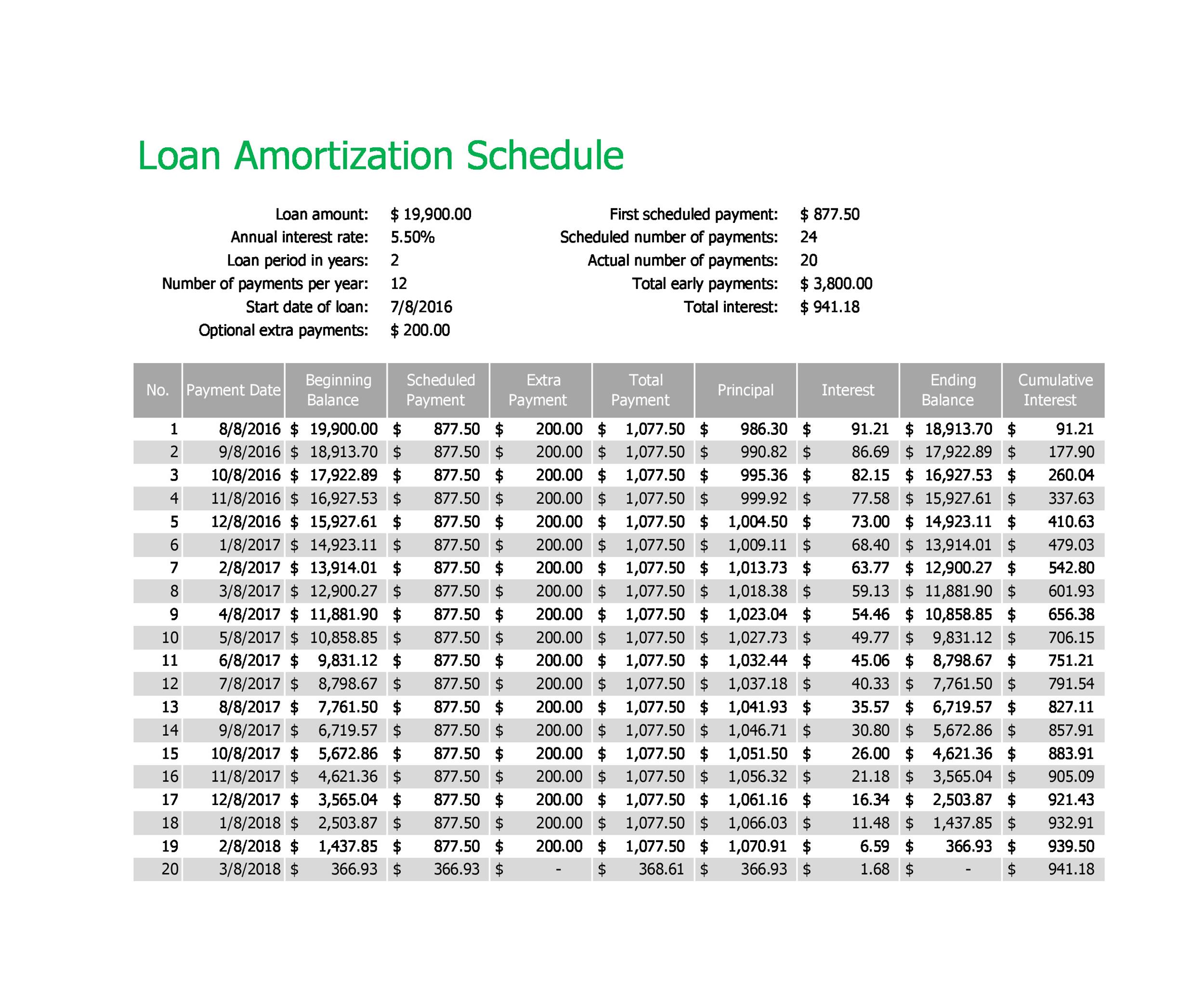

Another key element is the idea of structured payment, which denotes the incremental reduction of your debt through regular payments. Most mortgages conform to an repayment schedule, detailing how your payments will affect the principal and interest during the life of the loan. Using a mortgage calculator can help you model multiple scenarios, allowing you to evaluate how changes in APR, loan terms, or down payments will impact your total financial responsibility.

Important Calculations for Your Mortgage

To understand your real mortgage costs, start by figuring your monthly principal and interest payments. This is often done using a mortgage calculator, which needs inputs like the sum borrowed, interest rate, and duration of the loan. By inputting these figures, you can find out how much you will owe each month, allowing you to plan accordingly. Knowing this amount is crucial as it makes up the bulk of your monthly payment.

Furthermore, factor in property taxes and homeowner's insurance. These costs are usually included in your monthly mortgage payment through an escrow account. To get an exact monthly amount, project your annual property tax rate and homeowners insurance premium, then split by twelve. This extra amount will ensure you are preparing for the complete financial obligation that comes with homeownership beyond just the principal and interest.

Finally, consider potential mortgage insurance premiums if your down payment is under 20 percent. Mortgage insurance covers the lender in case of default and contributes to your monthly payment. Calculate hipotecalc.com based on your individual loan scenario, and include it in your total monthly payment. Understanding all these components in combination will provide a better picture of your actual mortgage costs and help you manage your finances effectively.

Frequent Mortgage Misconceptions Dispelled

Numerous people think that a 20% deposit is a strict requirement for buying a home. This false belief can be misleading, as various mortgage options exist that permit for reduced down payments. Programs such as Federal Housing Administration loans allow buyers to make as little as three percent, making homeownership more feasible for those who may not have significant savings. Realizing that there are alternatives can expand your options when seeking a mortgage.

An additional widespread misconception is that a better credit score guarantees the best mortgage rates. While a good credit score is crucial in obtaining good terms, lenders also take into account factors such as DTI ratio and the kind of loan. Even applicants with suboptimal scores can get competitive rates, especially if their complete financial picture is solid. It is vital to concentrate on improving your financial health in addition to just your credit score.

Lastly, many think that the only cost linked to a mortgage is the monthly cost. In reality, homeownership includes a variety of expenses such as property taxes, homeowner's insurance, and maintenance expenses. These extra expenses can greatly impact your total monthly budget. Using a loan calculator can help you calculate these costs with precision and provide a clearer picture of what you will really owe each month.